REEMPLOYED EXSERVICEMEN ASSOCIATION

Email : reemployedexsm@gmail.com

Website : www.reemployedexservicemen.blogspot.in

*********************************************************************************

Ref No : 4001/Pay Fixn/02 Date : 27 October 2015.

To

The Director General of Resettlement

Ministry of Defence, Govt of India

West Block IV, RK Puram

Delhi

Respected Sir,

Subject : PAY FIXATION OF REEMPLOYED EX-SERVICEMEN (PERSONNEL BELOW OFFICER RANK) IN CENTRAL GOVERNMENT DEPARTMENTS/ MINSTRIES

1. Please Refer to your Reply of grievance to Bikash De vide your office letter No CPGRAM/001015/2015 dated 10 Oct 2015. With profound regards it is submitted that pay fixation of reemployed Central Govt employees belong to ex-serviceman category who held below commissioned officer/Gp A Officer rank at the time of their retirement are not carried out as per Govt Orders issued from time to time due to misinterpretation/wrong clarification by various administrative authorities. The re-employed Ex-servicemen are being deprived by their employer/controlling authorities.

2. Statement of case for regularization/streamlining of pay fixation of reemployed ex-servicemen is enclosed herewith for your kind consideration and further approach to the competent authority/controlling authority i.e. Department of Personnel & Training to facilitate the rights of the veteran members of Indian Armed Forces please

Sd/- xxxxx

(Bikash De)

Secretary

Reemployed Ex-servicemen Association

Enclosures : (a) Statement of case.

(b) Appendix A (Illustration of pay fixation procedure).

(c) Appendix B to R (Related govt orders).

STATEMENT OF CASE FOR REGULARISATION OF PAY FIXATION OF REEMPLOYED EXSERVICEMEN (PERSONNEL BELOW OFFICER RANK) IN CENTRAL GOVERNMENT DEPARTMENTS/ MINSTRIES

INTRODUCTION

Government of India provides reemployment opportunity in various Departments/Ministries, Public Sector Organisation & Autonomous Bodies for Ex-Servicemen of Indian Armed Forces as a rehabilitation measure due to their retirement at early age. Most of the Exservicemen belong to PBOR category retired (discharged) from service on superannuation at the age of 37-40 years. To ensure the minimum survival support earnings govt of India introduced a higher stage of pay in several manners to the reemployed ex-servicemen from time to time. In all cases the pay is fixed either at the same stage as last pay drawn before retirement or grant advance increment for each year of service rendered in defence forces. The practice of fixation of pay in the reemployed post at the same stage as the last pay drawn before retirement by granting advance increment or some other means is still continued in some govt departments according to latest Govt Orders issued vide CCS (fixation of pay of re-employed pensioner) Orders, 1986, issued vide DOP&T O.M. No. 3/1/85-Estt. (Pay II) dated 31 July 1986 read with their O.M. No. 3/19/2009. Esst. Pay dated 05 April 2010, O.M. No 3/13/2008-Estt. (Pay II) dated 11 November 2008 and OM No. 3/19/2009-Estt. Pay-II dated 08 November 2010. (copy enclosed at Appendix B,C,D & E). Public Sector organizations i.e Nationalised Banks, LIC, FCI and other PSUs are still implementing the extended govt orders regarding the pay fixation of reemployed ex-servicemen as mentioned above. Pay protection is not allowed anywhere as the provision is not in extended government orders. It is apparent to mention that pay protection and pay fixation is not the same and the difference is clarified at Appx Fattached.

DETAILED JUSTIFICATION OF THE CASE

2. Departments under Central Government Ministries i.e. Department of Post, Audit & Accounts Department, Defence Accounts Dept, Railways and many others are not agreed to allow the pay fixation as mentioned vide paragraph 1 above to reemployed ex-servicemen belong to below officer rank of the Armed Forces. Basically the fixation of pay of reemployed ex-servicemen is regulated by the Govt Organization according to the instructions given in govt orders as mentioned above. Besides above orders your attention is invited to the Ministry of Finance, Dept. of Expdr. OM No 8(34)/Estt-III/57 dated 25 Nov 1958 and 5 (21) Estt-III(3)/64 dated 15 June 1964, CGDA letter No AT/II/2432-VI dated 15 Feb 1993 and CDA (Pension) Allahabad circular No 179 dated 12 May 2015, (Appx G - J attached).

2

3. (a) The relevant paragraphs of CCS (fixation of pay of re-employed pensioner) Orders, 1986 on which the pay fixation is dealt with as mentioned below :-

Para 4(d)(i) :

Ex-servicemen retired before the attaining the age of 55 years and held posts below Commissioned Officer rank in the Defence Forces and in the case of civilians who held posts below Group 'A' posts at the time of their retirement, the entire pension and pension equivalent of retirement benefits shall be ignored.

Para 4(d)(ii) :

The services officers belonging to the Defence Forces and Civilian Pensioner who held Gp 'A' posts at the time of their retirement, the first Rs.500/-* of the pension and pension equivalent retirement benefits shall be ignored. (*Already revised to Rs.4000/- vide O.M. No. 3/13/2008-Estt. (pay II) dated 11 th November, 2008).

Para 4(b)(i)

where the pension is fully ignored, the initial pay on re-employed shall be fixed as per entry pay in the revised pay structure of the re-employed post applicable in the case of direct recruits appointed on or after 1.1.2006 as notified vide Section II, Part A of First Schedule to CCS (RP) Rules, 2008.

Para 4(b)(ii) :

In cases where the entire pension and pensionary benefits are not ignored for pay fixation, the initial basic pay on re-employed shall be fixed at the same stage as the basic pay drawn before retirement, However, he shall be granted the grade pay of the re-employed post. The maximum basic pay cannot exceed the grade pay of the re-employed post plus pay in the pay band of Rs. 67000 i.e. the maximum of the pay band PB-4. In all these cases, the non-ignorable part of the pension shall be reduced from the pay so fixed. The specific clause is related to Retired Commissioned Officers of Armed forces category/Gp A Officers only.

(b) Relevant portion of DOPT OM No 3/13/2008/Estt/Pay II dated 11 Nov 2008 are as under :-

(i) The President is pleased to decide that, in partial modification of the Rule 2 (2)(vii) of the Central Civil Services (Revised Pay) Rules, 2008, the provisions of these rules shall apply to such persons also who were in re-employment on 1st January, 2006, subject to the orders hereinafter contained. This decision will cover all Government servants re-employed in Central Civil departments other than those employed on contract whether they have retired with or without a pension and/or gratuity or any other retirement benefits, e.g. contributory fund etc. from a civil post or from the Armed Forces.

3

(ii). Para 2 (i) : The initial pay of a re-employed Government servant who elects or is deemed to have elected to be governed by the revised pay scale from the 1st day of January, 2006 shall be fixed in the following manner namely –

According to the provisions of Rule 7 of the CCS. (R.P.) Rules, 2008, if he is-

(i) a Government servant who retired without receiving a pension, gratuity or other retirement benefit and

(ii) a retired Government servant who received pension or any other retirement benefits but which were ignored fixing pay on re-employment."

(c) Para 2 (ii) : The initial pay of a re-employed Government servant who retired with a pension or any other retirement benefit and whose pay on re-employment was fixed with reference to these benefits or ignoring a part thereof, and who elects or is deemed to have elected to be governed by the revised scales from the 1st day of January, 2006 shall fixed in accordance with the provisions contained in Rule 7 of the Central Civil Services (Revised Pay) Rules, 2008. In addition to the pay so fixed, the re-employed Government servant would continue to draw the retirement benefits he was permitted to draw in the pre-revised scales, as modified based on the recommendations of the Sixth Central Pay Commission, orders in respect of which have been issued separately by . the Department of Pension & Pensioners Welfare. However, an amount equivalent to the revised pension (excluding the ignorable portion of pension, wherever permissible), effective from 1.1.2006 or after, shall be deducted from his pay in accordance with the general policy of the Government on fixation of pay of re-employed pensioners. Annual increments will be allowed in the manner laid down in Rule 10 of Central Civil Services (Revised Pay) Rules, 2008, on the entire amount of pay as if pension had not been deducted.

4. From the above reference it is clear that the pay of reemployed ex-servicemen will be fixed according to rule 7 of CCS RP Rules 2008 with adherence to CCS (Fixation of pay of reemployed pensioners) Rules 1986 and DOP&T O.M dated 05 April 2010 in this regard. The term minimum pay refers here the pay last drawn by the reemployed ex-servicemen before retirement (substantive pay) and the pay should be fixed in the pay structure of reemployed post i.e. the grade pay of reemployed post only admissible in such case. Total pay should be equal to the last pay drawn by the pensioner. .In this regards your attention is invited to para 3(v) of DOPT OM dated 05 April 2010 (Appx C).

4

5. Public Sector Banks are still implementing the govt orders (DOP&T OM as per Appx B-Eattached) and pay fixation of the reemployed ex-servicemen allowed at the same stage as last pay drawn before retirement. Circular of Indian Banks Association is attached herewith at Appx K.

6. . Despite specific Government orders issued on the subject matter, the Department/Ministries under central govt. are not agreed to re-fix the pay of reemployed ex-servicemen (PBOR) category as mentioned in para 4 above. The reemployed Ex-serviceman belong to PBOR category are allowed to get their pay fixed only at the minimum/entry pay of re-employed post which is illogical and unlawful decision made by the authority.. The victims need to fight for their rights against the system as it shows the inability to pay the entitled wages to his own employees which is a constitutional right of every citizen. Being Indian we all are aware of Indian Armed Forces and service rendered by the soldiers and their supreme sacrifice for the nation since its inception. There may be some ambiguity in the Office Memorandum issued by DOP&T related to pay fixation but the departments should get the rules/provisions clarified from the issuing authority in a constructive manner. The applications for pay fixation of reemployed ex-servicemen kept un actioned for months after months and after repeated requests and reminders they issue a negative reply to the employee without knowing the rules and regulations of the subject concern. Even though most of the department/ministries do not have the relevant ruling letters available with them. Most of the officers are ignorant of the matter and they put the case deliberately delayed. It is apparent to mention that the reemployed ex-servicemen belongs to Commissioned Officer category are allowed to get their pay fixed at the same stage as last pay drawn before retirement in each and every department of government of India according to para 4b(ii) of CCS (fixation of pay of reemployed pensioners) Rules 1986 (Appx B att.). It shows a huge discrimination between the two different cadres belong to the same fraternity and both performed the same duty – defend our country from external aggression. The Jawans (PBOR) are deprived while in service and even after retirement. As a result a large number of ex-serviceman are suffering from financial hardship besides moral depression. No body think about their family, their life. The policy makers never think about the jawans, rather it was tactfully managed by them that the facility should not be extended to jawans who do not have any participation in formulating the policy. Discrimination created by the bureaucrats with regards to pay fixation of reemployed Officers and Jawans are clarified with illustration in Appx A attached. Now the situation has been changed. Jawans are no more just so called soldier. Besides fighting for the country they have learnt to nurture their own family. So, they are now able to raise their voice after retirement. In this digital era we can imagine that the information of such discrimination easily spreads to the serving soldiers of the three services.

5

The bureaucratic, dictatorship, dominated ruling is over. Hundreds of cases regarding pay fixation has been placed in the Central Administrative Tribunal and higher Judicial systems of the country.

7. After all it is a matter of shame in the realistic view. Quoting the same authority /Govt orders issued by DOP&T the PSU organizations and Banks have facilitate the pay fixation to the ex-servicemen (PBOR) to fix the pay at the same stage as last pay drawn before retirement but the department/ministries under central Govt. are still not agreed to provide the entitlements to the reemployed ex-soldiers. The points have been raised that the commissioned officer has been allowed to get their pay fixed as last pay drawn by them before retirement with condition to deduction of non ignorable portion of pension from the pay so fixed. In general it is an eye wash. Inspite of deduction still their minimum gain from this pay fixation is Rs 16850/-. Whereas the ex servicemen (PBOR) gets a big zero. The actual fact is revealed with practical implementation as per illustration given in Appx A attached.

REMEDIAL ACTION REQUIRED TO BE TAKEN

8. In view of the above, to remove the disparity and ambiguity, it is requested that the relevant portion of CCS (Fixation of pay of reemployed pensioners) Rules 1986 amended vide DOPT OM No 3/19/2009/Estt/Pay(II) dated 05 April 2010 should be modified as mentioned below :-

For :-

Para 4(b) (I)

In all cases where the pension is fully ignored, the initial pay on re-employment shall be fixed as per entry pay in the revised pay structure of the re-employed post applicable in the case of direct recruits appointed on or after 1.1.2006 as notified vide section II, Part A of First Schedule to CCS (RP) Rules, 2008

Read :-

Para 4(b) (I)

In cases where the pension is fully ignored by exercising option, the initial pay on re-employment shall be fixed as per entry pay in the revised pay structure of the re-employed post applicable in the case of direct recruits appointed on or after 1.1.2006 as notified vide section II, Part A of First Schedule to CCS (RP) Rules, 2008. In other cases of ex serviceman who held posts below commissioned officer rank in the Defence Forces and in the case of ex civilians who held posts below Group A posts at the time of their retirement and retired before attaining the age of 55 years,

6

their entire pension will be ignored for initial pay fixation and initial pay on re-employment shall be fixed at the same stage as the last pay drawn before retirement. Their pay will be fixed according to the illustration shown in para 4(b)(ii). In such case any part of pension will not be reduced from the pay so fixed as mentioned in para 4(d)(ii).

9. Once again it is requested that the orders should be issued with free from any ambiguity, clearly mentioning the feasibility of fixation of pay of the reemployed ex-servicemen belongs to below officer rank at the same stage as the last pay drawn before retirement with ignoring entire portion of pension. The reemployed ex-servicemen (PBOR) should also be entitled to draw pension/PEG separately. Thousands of reemployed soldiers suffering from acute financial hardship due to very low earning even after re-employed with Central Civil Services. They would get relief with the right approach and a patriotic initiative if taken at your end.

DOCUMENTARY EVIDENCE OF CORRECT IMPLEMENTATION OF GOVT ORDERS

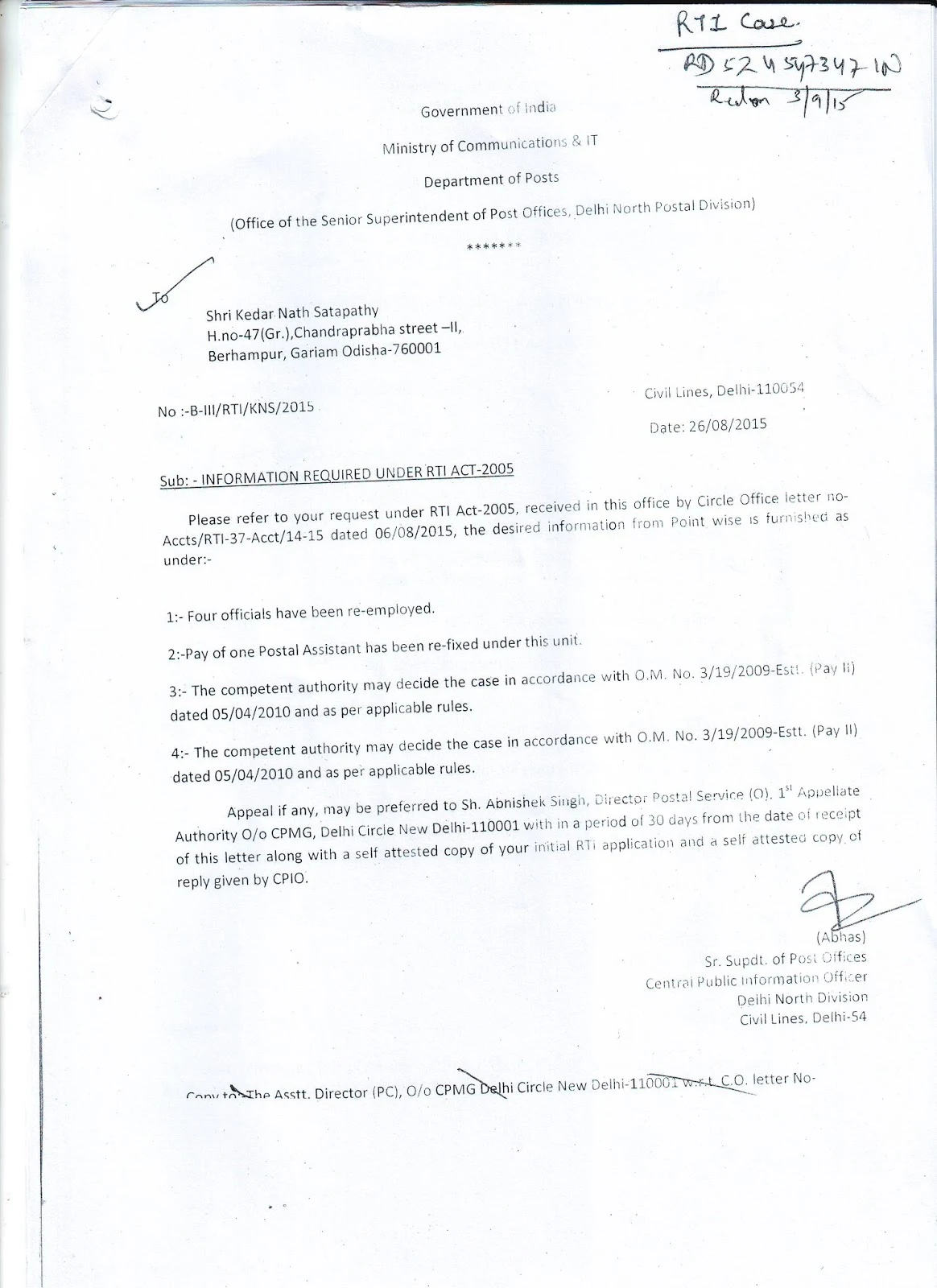

10. Details of pay fixation orders of few offices who already granted pay fixation to ex-soldiers are appended below with documentary evidence:-

(i) IBA Circular & clerification - Appx K

(ii) Dept of Post, Rajasthan Circle (Jaipur Dn)- Appx L

(iii) Income Tax Department - Appx M

(iv) Employees Privident Fund Organisation - Appx N

(v) Western Railway Pay fixation - Appx O

(vi) Clerification of EPFO - Appx P

(vii) Clerification of Western Railway - Appx Q

(viii) PIB Release - Appx R

Station : Kolkata (West Bengal)

Sd/- xxxxx

Date : 27 October 2015 (Bikash De)

Secretary

Reemployed Exservicemen Association

Appx A

COMPARATIVE ILLUSTRATION OF PRESENT PRACTICE OF FIXATION OF PAY OF REEMPLOYED EXSERVICEMEN BELONGS TO BELOW OFFICER RANK AND COMMISSIONED OFFICER RANK.

Illustration of Pay Fixation of a retired Commissioned Officer reemployed as Section Officer According to para 4 of CCS (fixation of pay of re-employed pensioner) Orders, 1986 (Revised).

Colonel ABC who retired at the age of 54 years.

|

Entry pay of his reemployed post :-

Pay in the pay band – Rs 15600/-

Grade Pay - Rs 5400/-

Total Pay - Rs 21000/-

|

His Pre retirement pay (Last pay drawn).

Pay in the pay band – Rs 53000/-

Grade Pay - Rs 8700/-

MSP - Rs 6000/-

Total Pay - Rs 67700/-

Pension sanctioned ( 50% of last pay drawn) = Rs 33,850/-

Ignorable part of pension for the purpose of pay fixation = Rs 4,000/-

Non Ignorable part of pension for the purpose of pay fixation = Rs 33850/- – Rs 4000/- = Rs 29850/-

Amount required to be deducted from the pay so fixed = Rs 29,850/-

Pay fixed in r/o Colonel (Retd) ABC in the reemployed post according to para 4 of CCS (fixation of pay of re-employed pensioner) Orders, 1986 revised from time to time :-

Total pay to be fixed at the same stage as last pay drawn = Rs 67,700/-

Non ignorable part of pension required to be deducted = Rs 29,850/-

Net pay fixed on reemployment (allowed to draw) = Rs 37,850/-

(Subject to drawal of pay plus gross pension on re-employment will not more than Rs. 80,000/-, the maximum salary payable to

the Secretary to the Government of India under Central Civil Services (Revised Pay) Rules, 2008.)

Pay of the reemployed commissioned officer in the re-employed post of Section Officer is fixed as:-

Pay in the Pay band –III. Band pay = Rs 32,450/- Grade Pay = Rs 5400/-

Entry pay admissible to fresher/new recruit for the post of Section Officer recruited through UPSC:-

Pay in the Pay band –III Band Pay = Rs 15,600/- Grade Pay = Rs 5400/-

Additional benefit allowed to reemployed Gp A/Commissioned officer = Rs 16,850/-

This benefit of pay fixation is not allowed to re-employed ex-serviceman who belongs to below officer rank (PBOR).

2

Illustration of Pay Fixation of an Ex-Serviceman (Personnel Below Officer Rank) reemployed in the post of LDC. According to para 4 of CCS (fixation of pay of re-employed pensioner) Orders, 1986 due wrong interpretation of Govt orders.

Havilder XYZ who retired at the age of 40 years.

|

Entry pay of his reemployed post (LDC):-

Pay in the pay band – Rs 5830/-

Grade Pay - Rs 1900/-

Total Pay - Rs 7730/-

|

His Pre retirement pay (Last pay drawn).

Pay in the pay band – Rs 9550/-

Grade Pay - Rs 2800/-

MSP - Rs 2000/-

Classification Pay - Rs 300/-

Total Pay - Rs 14650/-

Pension sanctioned ( 50% of last pay drawn) = Rs 7325/-

Ignorable part of pension for the purpose of pay fixation = Rs 7325/- (entire pension/PEG)

Pay of the reemployed Ex Serviceman in the re-employed post of LDC is fixed according to wrong interpretation of Para 4 (b) (i) (by the administrative authority) of CCS (fixation of pay of re-employed pensioner) Orders, 1986 (revised) :-

Pay in the Pay band –I. Band pay = Rs 5830/- Grade Pay = Rs 1900/-

Total pay = Rs 7730/- (Entry pay/minimum pay of the reemployed post as admissible to fresher/new recruit for the post of LDC recruited through SSC/other agencies)

Our demand is to fix the pay of reemployed ex-serviceman at the same stage as the last pay drawn before retirement in the following manner as entitled vide DOPT OM attached at Appx B duly incorporated with DOPT OM dated 11 Nov 2008 (Appx C) :-

PROPOSED

Pay in the Pay band –I. Band pay = Rs 12750 /- Grade Pay = Rs 1900/-

Total pay = Rs 14650/-

Deprived due to incorrect fixation of pay at the minimum pay of reemployed post = Rs 6920/- per month (Basic pay only).

From the above comparative illustration it is revealed that the re-employed Ex-servicemen who held below Commissioned Officer Rank in the Armed Forces at the time of their retirement, are being deprived and this is contrary to the natural justice and violation of fundamental rights.. Commissioned Officers/Gp A officers must get their entitled pay in their reemployed posts as mentioned in the relevant rules/orders issued by DOP&T but PBOR also should get the same if we consider them part of the Indian Armed Forces and we remember their sacrifice for our country besides authorization as mentioned in the constitutionally approved govt orders. .

3

DETAILED CLERIFICATION

The Personnel Below Officer Rank (PBOR) of the Indian Armed Forces mostly retired on superannuation after completion of 17- 20 years of service at an average age of 40 years in the rank of Havilder or Sepoy/Nk and equivalent rank of Navy/Air Force. Scope of resettlement in the Govt sector is too less whereas requirement is too much. Only 3% veterans get Govt job against the 5% Ex-serviceman quota reserved for Gp C & D posts only. The eligible, qualified and experienced Ex-serviceman recruited mostly in the Group D/MTS/LDC/equivalent posts in the Central Govt in Pay Band –I (Rs 5200-20200) with grade pay of Rs 1800/1900. The initial gross pay/entry pay including DA and other allowances as on date is appeared to be less than Rs 17000/-pm. Pension sanctioned including DR at an average is now Rs 10,000/- pm. The total monthly income after 20 years of service is Rs 27,000/- pm. Whereas a central govt servant with similar profile and 20 years of service is drawing his salary not less than Rs 50,000/- pm. Even a newly recruited LDC in any govt office with only 7 years of service is drawing Rs 30,000/-pm.

Service rendered by an Ex-serviceman never can be compared with the fresher, as veterans have wide experience of versatile nature of work, highly motivated, disciplined and trained for prompt actions with demand of situation and it has been proved in the PSU/Banks that the productivity/efficiency of the ESM category of manpower is almost 95% more than the fresher and they have honoured their efficiency/service experience in the form of allowing the pay fixation/ protection of last pay drawn (Copy of Circular of Indian Banks Association enclosed in Appx ).

According to the requirement of the stages of life the minimum supported wages to the reemployed veteran who sacrificed their youthfulness in the sake of the nation must be considered by the competent authority. This is not a mercy to the veteran, they deserve it and it is the right of the veterans who were separated from family and relatives for a long, posted in the field/CI Ops/Hazard area and dedicate their lives to serving their country to protecting the people of India. Soldiers paid the ultimate sacrifice for their country. Orders of the Commanding officer are the last word for them. Soldier never thought on the battle field that it is dangerous, he might get wounded, he might even die | Had they died, it would be because they laid down their lives for their country. They chose to obey without regard for the cost. The living veteran may not have a grave marker as a memorial, but they nevertheless gave much for our country. The memories linger. The competent authority should consider the facts and issue necessary instructions to facilitate the benefit of pay fixation to ex-serviceman (PBOR) on reemployment at the same stage as the last pay drawn before their retirement.

4

APPEAL

The Controlling/Competent authority is requested to go through the relevant orders with a realistic view and reform the rules in favour of Ex-serviceman. Though a few departments/offices under ministries have allowed pay fixation to reemployed Ex serviceman (PBOR) as per Para 4(b)(ii) with a logical view of the provisions of different criteria mentioned in the CCS (Fixation of pay of reemployed rules) 1986 incorporated with DOPT OM dated 11.11.2008 (AppxC). Meanwhile, DOP&T has issued their clarification to the Dept of Post that the Ex-serviceman are not entitled to get pay protection. Though we are not claiming pay protection but pay fixation as allowed to the Gp A officers/Commissioned Officers. The reemployed Gp A/Commissioned officers are still allowed to get the benefit in the version of pay fixation as last pay drawn before retirement. In natural view of justice the practice is inhumane and discriminative. It is apparent to mention that our demand is pay fixation and not pay protection. DOP&T should clarify the provisions of para 4(a) & (b)(i)&(ii) with partial modification if required and issue orders in such a manner with clear indication that the reemployed ex-serviceman who held below officer rank before retirement and retired before attaining the age of 55 years shall be allowed to get their pay fixed at the same stage as the last basic pay drawn by them before retirement.. However, they will be allowed to draw grade pay of the reemployed post only. The entire pension and pension equivalent of retirement benefits shall be ignored in this case. Remaining provision of para 4(c), 4(d) (i) & (ii) should be remain unchanged. An illustration in this regard may provide guidelines to the administrative authorities.

CONCLUSION

In the conclusion it is stated that the pay fixation benefit to the reemployed ex-serviceman on their reemployment as mentioned above should be allowed at the realistic grounds as they deserve it. Competent authority should consider the prayer in order to ensure minimum supportive earning in comparisons with similar profile civilian employees as the same has already been allowed to the Retired Gp A/Commissioned Officers reemployed in the Central Govt Departments/Ministries. An early disposal of the case with positive outcomes is anticipated.

Station : Kolkata (West Bengal)

Sd/- xxxxx

Date : 27 October 2015 (Bikash De)

Secretary

Reemployed Exservicemen Association