CLARIFICATION OF PAY FIXATION OF REEMPLOYED EXSERVICEMEN WORKING WITH SUBORDIATE OFFICES UNDER MINISTRY OF LABOUR AND EMPLOYMENT IS APPENDED BELOW. ALL ESM ARE REQUESTED TO APPROACH THEIR CONCERNED SANCTIONING AUTHORITY FOR FIXATION OF AS PER DOPT ORDERS.

EMPLOYEES’ PROVIDENT FUND ORGANISATION

(Ministry of Labour& Employment, Government of India)

Regional Office, Peenya

No.S(1)(F), 1st Cross, 1st Stage, Peenya, Bangalore – 560058.

Tel: 23721344/23721366; Fax: 28374424; E-mail: ro.peenya@epfindia.gov.in

No.KN/PY/PF/ADM/2015-16/ Date: 13-07-2015

By Name to: To,

Shri. M. Narayanappa, The Addl. Central P.F Commissioner (Kar & Goa)

Addl CPFC-I Employees’ Provident Fund Organisation,

Zonal Office, “Kaveri”, Bhavishyanidhi Enclave,

HMT Main Road, Jalahalli,

Bangalore – 560 013.

Sub: Fixation of pay in respect of re-employed Ex-servicemen in EPFO

Ref: 1. No. EPFO/ACC(K&G)/PNY-1/HRM/505/2015-16 dated 18/06/2015.

2. HRM/IV/5(1)2009/Ex-Sm/4772 dated 10/06/2015.

3. HRM/IV/5(1)2009/Ex-Sm/6357 dated 01/06/2012.

****

1. With reference to the above, fixation of pay of re-employed ex-servicemen in Peenya Region is done in accordance with DoPT OM No. 3/19/2009-Estt. (Pay II) dated 05/04/2010 as advised by HO vide letter referred at Sl No. 3 above. The said Memorandum has advised to refer DoPT OM No. 3/13/2008-Estt (Pay II) dated 11/11/2008 and has also stated that the pay fixation of re-employed pensioners on re-employment in Central Government, including that of Defence Forces personnel/officers, is being done in accordance with CCS (Fixation of Pay of Re-employed Pensioners) Orders, 1986 issued vide DoPT O.M No. 3/1/85-Estt. (Pay II) dated 31/07/1986 as revised from time to time. It is also informed that all the re-employed ex-servicemen have retired from the Armed Forces in the rank of PBOR (Personnel Below Officer Rank) before attaining the age of 55 years.

2. The salient features of the DoPT O.M dated 11/11/2008 referred above are as follows:

(a) The FR 2(2)(vii) which initially had sought not to apply the CCS (RP) Rules 2008 to persons re-employed in EPFO after retirement has now been modified to apply the CCS (RP) Rules, 2008 to all Government servants including Armed Forces retired with or without pension or any other retirement benefits.

(b) Para 2(1) of the letter states that the initial pay of re-employed Govt. servants who elects or is deemed to have elected to be governed by the revised pay scale from 01/01/2006 shall be fixed as per Rule 7 of CCS (RP) Rules, 2008, if he is:

(i) A Govt. servant who retired without receiving a pension, gratuity or any other retirement benefits.

(ii) A retired Govt. servant who received pension or any other retirement benefits but which were ignored while fixing pay on re-employment.

(c) As per Para 2(ii) of the O.M, the re-employed Govt. servant would continue to draw the retirement benefits he was permitted to draw in the pre-revised scales. However, an amount equivalent to the revised pension (excluding the ignorable portion of pension, wherever permissible) effective from 01/01/2006 or after, shall be deducted from his pay. As per Para 6 of the OM, the ignorable part of pension has been revised to ₹ 4,000/- in the case of Commissioned Officers.

3. The salient features of DoPT OM No. 3/19/2009-Estt. (Pay II) dated 05/04/2010 are as follows:

(a) After introduction of the system of running pay bands and grade pay, the relevant provisions of CCS (Fixation of Pay of Re-employed Pensioners) Orders, 1986 issued vide DoPT O.M No. 3/1/85-Estt. (Pay II) dated 31/07/1986 have been amended.

(b) Para 4(a) of the OM has been revised and is stated as “Re-employed pensioners shall e allowed to draw pay only in the prescribed pay scale/pay structure of the post in which they are re-employed. No protection of the scales of pay/pay structure of the post held by them prior to retirement shall be given. Under the provisions of CCS (RP) Rules, 2008, revised pay structure comprises the Grade Pay attached to the post and the applicable pay band.” This point could be clarified by the following illustration:

Suppose an ex-serviceman was drawing pay in the Pay Band PB2 (9300-34800, GP 4200) and his Basic Pay was ₹ 19700/- (i.e. ₹ 15,500 Pay in PB and ₹ 4,200/- GP) prior to retirement from the Armed Forces and on re-employment in the EPFO in the Pay Band PB1 (5200-20200, GP 2400), he cannot claim the PB2 (9300-34800 with GP 4200).

(c) Para 4(b)(i) of the said OM states that “In all cases where the pension is fully ignored, the initial pay on re-employment shall be fixed as per entry pay in the revised pay structure of the re-employed post applicable in the case of direct recruits appointed on or after 01/01/2006 as notified vide Section II, Part A of First schedule to CCS (RP) Rules, 2008”. The ignorable and non-ignorable part of pension for the purpose of fixation of pay of ex-servicemen is dealt in Para 4 (d), wherein, it is stated that, “In the case of persons retiring before attaining the age of 55 years and who are re-employed, pension (including PEG and other forms of retirement benefits) shall be ignored for initial pay fixation in the following extent:

(i) In the case of ex-servicemen who held posts below Commissioned Officer rank in the Defence Forces and in the case of civilians who held posts below Group ‘A’ posts at the time of their retirement, the entire pension and pension equivalent of retirement benefits shall be ignored.

(ii) In the case of Commissioned Officers belonging to the Defence Forces and Civilian pensioners who held Group ‘A’ posts at the time of their retirement, the first ₹ 4,000/- of the pension and pension equivalent retirement benefits shall be ignored”.

(d) Fixation of pay of personnel/officers who retired prior to 01/01/2006 and who have been re-employed after 01/01/2006 in Peenya region is done in accordance with Para 3(v) of the said OM, which states that, “their pay on re-employment will be fixed by notionally arriving at their revised basic pay at the time of retirement as if they had retired under the revised pay structure. This will be done with reference to the fitment table of the Defence Service Rank/Civilian service post (as the case may be) from which they had retired and the stage of basic pay at the time of their retirement. Their basic pay on re-employment will be fixed at the same stage as the notional last basic pay before retirement so arrived at. However, they shall be granted the grade pay of the re-employed post. The maximum basic pay cannot exceed the grade pay of the re-employed post plus pay in the pay band of ₹ 67,000/-, i.e. the maximum of the pay band PB-4. In all these cases, the non-ignorable part of the pension shall be reduced from the pay so fixed.

3. It is pertinent to note that only relevant provisions of the CCS (Fixation of Pay of Re-employed Pensioners) Orders, 1986 issued vide DoPT O.M No. 3/1/85-Estt. (Pay II) dated 31/07/1986 have been amended, while the remaining part of the Orders are retained. Para 3 of this OM states the Pre-Retirement Pay to be considered for initial fixation of pay of re-employed military pensioners which is as mentioned below:

(a) For Army: Pay (including deferred pay) and rank pay, Grade/trade/technical/ and rank Corps pays, Increments of pay for length of service, Good Service/Good conduct pay, Proficiency pay/ special Good Service pays, Classification pay, Deferred pay, Personal Allowance (Ris/Sub.Major), Extra Duty pays.

(b) For Navy: Basic Pay, pay (including deferred Pay), Good Conduct pay, Non- Substantive Pay, War service Increments Higher Pt. II –Qualification pay, Good/Deferred Pay Classification Pay.

(c) For Air Force: Basic Pay, Pay (including deferred pay), Good Service/Good Conduct pay. Air Proficiency pay, Badge pay, War Service increments, Classification pay, Deferred pay.

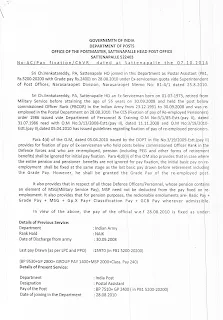

4. In this regard, it has been clarified by the Ministry of Defence (Finance) as communicated by CGDA vide letter No. AT/II/2432-VI dated 15/02/1993 (copy enclosed) that in all cases where the entire amount of pension is ignored, the initial pay on re-employment has to be fixed at the minimum of the scale of the re-employed post and therefore there is no necessity of indicating the pay drawn by the individual from the date of enrolment to the date of discharge, and only particulars of Last Pay drawn will serve the purpose. In other words, where the entire amount of pension is ignored, furnishing the Last Pay drawn particulars of Military Pensioner will suffice for the purpose of fixation of pay on re-employment. It may be noted that due to the introduction of running Pay Bands and Grade Pay in the 6th CPC, the term “Minimum Pay” has been replaced with “Entry Pay” in the revised Pay Structure as given in Para 4 (b)(i) of the DoPT O.M dated 05/04/2010.

5. It is submitted that there are two categories of ex-servicemen who are re-employed in EPFO at Peenya Region, viz. those retired prior to 01/01/2006 and re-employed after 01/01/2006, and those retired after 01/01/2006 and re-employed thereafter. The following paragraphs explain the manner of fixation of pay of the re-employed pensioners of Peenya Region:

(a) In the case of ex-servicemen who retired prior to 01/01/2006 and re-employed after 01/01/2006:

In these cases, fixation of pay has been done in accordance with Paras 4 (d) (i) and 3(v) of DoPT O.M dated 05/04/2010, i.e. by notionally arriving at their revised basic pay at the time of retirement as if they had retired under the revised pay structure. For this purpose, the fitment table of the Defence Service Rank from which they had retired, the stage of basic pay at the time of their retirement and the elements of Pre-Retirement Pay as per their Last Pay Certificate was taken into consideration and their basic pay on re-employment was fixed at the same stage as

the notional last basic pay before retirement so arrived at. They have been granted the grade pay of the re-employed post, i.e. ₹ 2,400/-. The entire pension and pension equivalent gratuity have been ignored for the purpose of fixation of pay, as all these ex-servicemen have retired from the defence forces before attaining the age of 55 years and in the rank below Commissioned Officer

Rank, i.e. Personnel Below Officer Rank (PBOR). Illustration of the fixation is given below:

| Service retired from | Indian Air Force |

| Date of Retirement from IAF | 30/04/2004 |

| Pay as on date of retirement (As per LPC) | Basic Pay = ₹ 4,745 |

| Good Conduct Badge Pay = ₹ 120 |

| Corresponding Pay as per fitment table | Basic Pay = ₹ 4,745 x 1.86 = ₹ 8,830 Grade Pay = ₹ 2,800 MSP = ₹ 2,000/- Total Pay = ₹ 13,630/- + ₹ 120/- (GCB Pay) = ₹ 13,750/- (Note: GCB Pay is part of Pre-Retirement Pay mentioned in Para 3 (c) above) |

| Date of joining EPFO on re-employment | 12/06/2006 |

| Pay fixed on re-employment in the EPFO as on 12/06/2006. | Pay in PB = ₹ 11,350/- Grade Pay = ₹ 2,400/- Total = ₹ 13,750/- |

(b) In the case of ex-servicemen retired after 01/01/2006 and re-employed thereafter:

In these cases, the fixation of pay is done in accordance with Para 4 (b)(i), 4 (d)(i) and Para 3(v) of DoPT O.M dated 05/04/2010. For this purpose, all the elements constituting Pre- Retirement Pay as mentioned in Para 3 above and as obtained from their Last Pay Certificate and PPO have been consolidated to form the Entry Pay. The amount so arrived at has been fixed as the Basic Pay as on the date of joining EPFO. They have been granted the grade pay of the re- employed post, i.e. ₹ 2,400/-. The entire pension and pension equivalent gratuity have been ignored for the purpose of fixation of pay, as all these ex-servicemen have retired from the defence forces before attaining the age of 55 years and in the rank below Commissioned Officer Rank, i.e. Personnel Below Officer Rank (PBOR). Illustration of the fixation is given below:

| Service retired from | Indian Air Force |

| Date of Retirement from IAF | 30/06/2009 |

| Pay as on date of retirement (As per LPC) | Pay in PB = ₹ 11,930 |

| Grade Pay = ₹ 4,200/- |

| MSP = ₹ 2,000/- |

| Classification Pay = ₹ 0/- |

| Good Conduct Badge Pay = ₹ 240/- (Note: GCB Pay is part of Pre-Retirement Pay mentioned in Para 3 (c) above) |

| Total = ₹ 18,370/- |

| Date of joining EPFO on re-employment | 23/08/2010 |

| Pay fixed on re-employment in the EPFO as on 23/08/2010 | Pay in PB = ₹ 15,970/- Grade Pay = ₹ 2,400/- Total = ₹ 18,370/- |

6. It may be noted that Para 4(b)(i) states that where pension is fully ignored, the initial pay on re-employment shall be fixed as per entry pay in the revised pay structure of the re-employed post

applicable in the case of direct recruits. Here, it is to be understood that the entry pay of a fresh direct recruiton appointment to the post of SSA is fixed at ₹ 7,510/-, which is the minimum for the post and is

to be done in accordance with Rule 8 of CCS (RP) Rules, 2008. Whereas, fixation of pay of ex-servicemen is governed by Rule 7 of CCS (RP) Rules, 2008, as stated in DoPT O.M dated 11/11/2008.

7. Further, as regards Military Service Pay (MSP) is concerned, DoPT O.M. 3/19/2009 Estt (Pay II) dated 08/11/2010 clearly states that “in respect of all those Defence Officers/Personnel whose pension contains an element of MSP that need not be deducted from the pay fixed on re-employment. In other words, MSP will have to be reckoned for fixation of pay on re-employment.

8. The pay of ex-servicemen re-employed in EPFO at Peenya Region has been fixed by taking into consideration the relevant provisions of the Rules stated above. The pay fixation methodology adopted by Income Tax Department in fixation of pay of re-employed ex-servicemen in their department has also been taken into consideration for the purpose.

Yours faithfully,

Sd/--

[K. NARAYANA]

Regional P.F. Commissioner-I

Peenya Region

Encl: As stated

Copy to:

The Central Provident Fund Commissioner [Byname to: Shri. Amit Singla, RPFC-II (HRM-IV)]

Employees Provident Fund Organisation,

Bhavishya Nidhi Bhavan, Head Office,

No. 14, Bhikaji Cama Place,

New Delhi – 110 006.

Sd/----

[K. NARAYANA]

Regional P.F. Commissioner-I

Peenya Region